- Posts: 996

- Thank you received: 26

Zonte Video - February 19, 2024

Zonte Aug. 10, 2023 Video

Login Form

New subscribers, setup your Login ( Menu-Login)

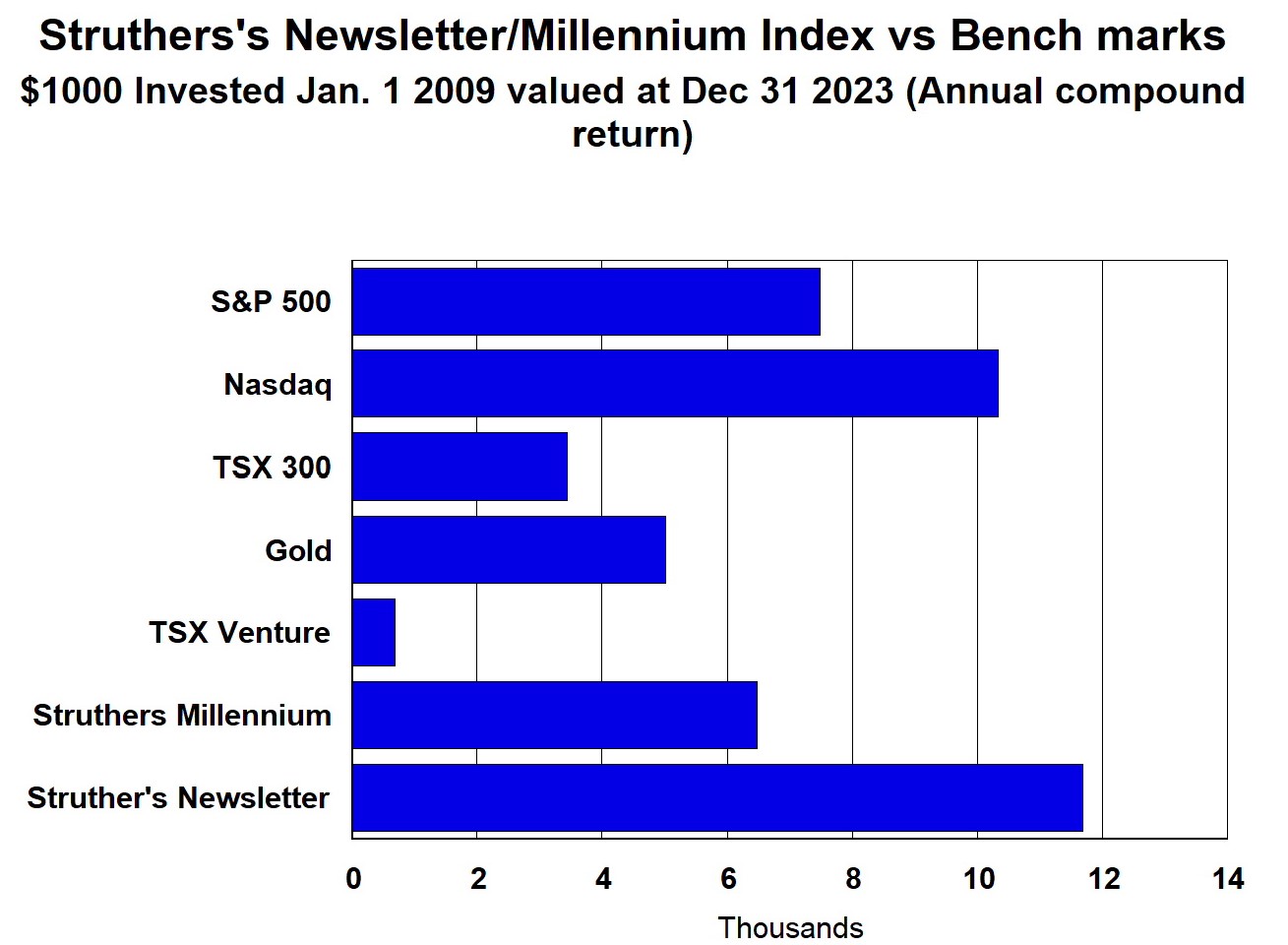

Performance 2009 to 2023 (compound annual)

Market Sentiment shifting

- Gambler

-

- Offline

- Platinum Member

-

Less

More

5 years 5 months ago #121451

by Gambler

Gambler replied the topic: Market Sentiment shifting

Quite a drop in US$ yesterday, good for Gold +$20, see if we get weak employment numbers - might cause US$ to fall further

Please Log in or Create an account to join the conversation.

- RonS

-

Topic Author

Topic Author

- Offline

- Moderator

-

Less

More

- Posts: 598

- Thank you received: 58

5 years 5 months ago #121430

by RonS

RonS replied the topic: Market Sentiment shifting

Today December gold broke above $1240, we should see continued rally to around $1275

Please Log in or Create an account to join the conversation.

- alexgreat

-

- Offline

- Platinum Member

-

Less

More

- Posts: 638

- Thank you received: 18

5 years 6 months ago #121256

by alexgreat

alexgreat replied the topic: Market Sentiment shifting

Good interview here with Sprott

stockhead.com.au/resources/words-of-wisd...nvestor-eric-sprott/

Mr Sprott also pointed to how much silver is traded each day.

“Silver trades 500 million ounces a day, we mine about 860 [million ounces each year],” he explained.

“We’re trading 60 per cent of the world’s yearly production every day. Why do we trade that much when everyone hates it anyway?”

Mr Sprott did, however, concede that gold has had a bit of a bad time since 2011.

“Every time you read something, something fatalistic is going to happen to gold and silver,” he said.

“Not that it hasn’t by the way for the last six years okay, it has. Ever since 2011 it has been kind of a tough road. There are good times and there are bad times in the gold business.”

stockhead.com.au/resources/words-of-wisd...nvestor-eric-sprott/

Mr Sprott also pointed to how much silver is traded each day.

“Silver trades 500 million ounces a day, we mine about 860 [million ounces each year],” he explained.

“We’re trading 60 per cent of the world’s yearly production every day. Why do we trade that much when everyone hates it anyway?”

Mr Sprott did, however, concede that gold has had a bit of a bad time since 2011.

“Every time you read something, something fatalistic is going to happen to gold and silver,” he said.

“Not that it hasn’t by the way for the last six years okay, it has. Ever since 2011 it has been kind of a tough road. There are good times and there are bad times in the gold business.”

Please Log in or Create an account to join the conversation.

- alexgreat

-

- Offline

- Platinum Member

-

Less

More

- Posts: 638

- Thank you received: 18

5 years 6 months ago #121199

by alexgreat

alexgreat replied the topic: Market Sentiment shifting

Monday, October 1, 2018

www.marketwatch.com/story/bank-of-nova-s...a-charged-by-cftc-wi ...

The Bank of Nova Scotia was charged by the Commodity Futures Trading Commission with multiple acts of spoofing in gold and silver futures between June 2013 and June 2016. Traders placed orders to buy or sell precious metals futures contracts with the intent to cancel the orders before execution, the CFTC said.

The CFTC fine was $800,000, as the CFTC said the penalty was substantially reduced because the bank reported the conduct to the agency.

* * *

Far from criticizing the bank, the CFTC's announcement yesterday about the misconduct actually praises the bank for having reported the misconduct itself:

cftc.gov/PressRoom/PressReleases/7818-18

The CFTC's enforcement director, James McDonald, says:

"This case is another great example of the significant benefits of self-reporting and cooperation. We expect market participants to take proactive steps to prevent this sort of misconduct before it starts. But, as this case shows, there is a strong incentive for market participants to quickly and voluntarily report wrongdoing when it is discovered and cooperate with our investigation, as the Bank of Nova Scotia did here. In recognition of its self-reporting and cooperation, the commission imposed a substantially-reduced penalty."

www.marketwatch.com/story/bank-of-nova-s...a-charged-by-cftc-wi ...

The Bank of Nova Scotia was charged by the Commodity Futures Trading Commission with multiple acts of spoofing in gold and silver futures between June 2013 and June 2016. Traders placed orders to buy or sell precious metals futures contracts with the intent to cancel the orders before execution, the CFTC said.

The CFTC fine was $800,000, as the CFTC said the penalty was substantially reduced because the bank reported the conduct to the agency.

* * *

Far from criticizing the bank, the CFTC's announcement yesterday about the misconduct actually praises the bank for having reported the misconduct itself:

cftc.gov/PressRoom/PressReleases/7818-18

The CFTC's enforcement director, James McDonald, says:

"This case is another great example of the significant benefits of self-reporting and cooperation. We expect market participants to take proactive steps to prevent this sort of misconduct before it starts. But, as this case shows, there is a strong incentive for market participants to quickly and voluntarily report wrongdoing when it is discovered and cooperate with our investigation, as the Bank of Nova Scotia did here. In recognition of its self-reporting and cooperation, the commission imposed a substantially-reduced penalty."

Please Log in or Create an account to join the conversation.

- lynnsa10

-

- Offline

- Platinum Member

-

Less

More

- Posts: 538

- Thank you received: 27

5 years 6 months ago #121198

by lynnsa10

lynnsa10 replied the topic: Market Sentiment shifting

Central Banks are big buyers 1st half of this year and now Poland joins in

Poland has embraced gold this summer, purchasing the yellow metal at a pace not seen in 20 years, according to the International Monetary Fund data.

Taking advantage of lower prices, the European country added nine metric tons to its gold reserves in July and August, which marked the biggest acquisition since 1998. The purchase is valued at around $355 million based on current gold prices.

“The NBP [National Bank of Poland] reserve management policy is based on diversification,” mBank SA senior economist Marcin Mazurek told Bloomberg. “Perhaps the basic criterion is the low price of the gold, combined with the expectation for higher global inflation.”

Even though the country’s gold holdings are still not even in the top 30, the purchase bumped the Polish bullion reserves to the highest level since 1983. Poland’s gold reserves now stand at 112.3 metric tons.

Poland has embraced gold this summer, purchasing the yellow metal at a pace not seen in 20 years, according to the International Monetary Fund data.

Taking advantage of lower prices, the European country added nine metric tons to its gold reserves in July and August, which marked the biggest acquisition since 1998. The purchase is valued at around $355 million based on current gold prices.

“The NBP [National Bank of Poland] reserve management policy is based on diversification,” mBank SA senior economist Marcin Mazurek told Bloomberg. “Perhaps the basic criterion is the low price of the gold, combined with the expectation for higher global inflation.”

Even though the country’s gold holdings are still not even in the top 30, the purchase bumped the Polish bullion reserves to the highest level since 1983. Poland’s gold reserves now stand at 112.3 metric tons.

Please Log in or Create an account to join the conversation.

- Gambler

-

- Offline

- Platinum Member

-

Less

More

- Posts: 996

- Thank you received: 26

5 years 6 months ago #121194

by Gambler

Gambler replied the topic: Market Sentiment shifting

Short Squeeze May Send Gold Price Spiking

October 2 (King World News) – John Ing: “The reason the gold market is spiking today is because of the crisis in Italy. This raises the prospects of the EU falling apart. Eric, if we see another $10 surge, we will see a major scramble that will create a major short squeeze in the gold market…

kingworldnews.com/gold-spikes-17-silver-...d-may-spike-to-1375/

October 2 (King World News) – John Ing: “The reason the gold market is spiking today is because of the crisis in Italy. This raises the prospects of the EU falling apart. Eric, if we see another $10 surge, we will see a major scramble that will create a major short squeeze in the gold market…

kingworldnews.com/gold-spikes-17-silver-...d-may-spike-to-1375/

Please Log in or Create an account to join the conversation.

- Gambler

-

- Offline

- Platinum Member

-

Less

More

- Posts: 996

- Thank you received: 26

5 years 6 months ago #121162

by Gambler

Gambler replied the topic: Market Sentiment shifting

Fed rate news today, Gold often rallies after the rate hike. We will soon find out

Please Log in or Create an account to join the conversation.

- Gambler

-

- Offline

- Platinum Member

-

Less

More

- Posts: 996

- Thank you received: 26

5 years 7 months ago #121027

by Gambler

Gambler replied the topic: Market Sentiment shifting

2.9% in wage growth in latest report is inflationary and good for Gold

Please Log in or Create an account to join the conversation.

- WealthyPlumber

-

- Offline

- Senior Member

-

Less

More

- Posts: 49

- Thank you received: 0

5 years 7 months ago #120970

by WealthyPlumber

WealthyPlumber replied the topic: Market Sentiment shifting

Ron's last report seems bang on, nice rally in Gold

Please Log in or Create an account to join the conversation.

- GoldnBoy

-

- Offline

- Platinum Member

-

Less

More

- Posts: 1179

- Karma: 1

- Thank you received: 26

5 years 8 months ago #120891

by GoldnBoy

Please Log in or Create an account to join the conversation.

- RonS

-

Topic Author

Topic Author

- Offline

- Moderator

-

Less

More

- Posts: 598

- Thank you received: 58

5 years 8 months ago #120855

by RonS

RonS replied the topic: Market Sentiment shifting

If the US moves to weak dollar policy, very positive for Gold

"The real risk is that we have broad-based unravelling of global trade and currency cooperation, and that is not going to be pretty," said Jens Nordvig, Wall Street's top-ranked currency strategist for five years running before founding Exante Data LLC in 2016. "Trump's rhetoric over the last 24 hours is certainly shifting this from a trade war to a currency war." ...

The Treasury Department declined to comment when asked whether the U.S. was entering a currency war.

The greenback will likely continue to suffer as investors heed Trump and back out of long dollar wagers, according to Shahab Jalinoos, Credit Suisse Group AG's global head of FX trading strategy. Hedge funds and other speculators are the most bullish on the currency in over a year, according to the latest data from the Commodity Futures Trading Commission.

"It has now been virtually defined as a currency war by the U.S. president, given that he explicitly suggested foreign countries are manipulating exchange rates for competitive purposes," Jalinoos said. "The barrage of commentary will likely force the market to scale back long dollar positions."

www.bloomberg.com/news/articles/2018-07-...-eu-for-manipulating

"The real risk is that we have broad-based unravelling of global trade and currency cooperation, and that is not going to be pretty," said Jens Nordvig, Wall Street's top-ranked currency strategist for five years running before founding Exante Data LLC in 2016. "Trump's rhetoric over the last 24 hours is certainly shifting this from a trade war to a currency war." ...

The Treasury Department declined to comment when asked whether the U.S. was entering a currency war.

The greenback will likely continue to suffer as investors heed Trump and back out of long dollar wagers, according to Shahab Jalinoos, Credit Suisse Group AG's global head of FX trading strategy. Hedge funds and other speculators are the most bullish on the currency in over a year, according to the latest data from the Commodity Futures Trading Commission.

"It has now been virtually defined as a currency war by the U.S. president, given that he explicitly suggested foreign countries are manipulating exchange rates for competitive purposes," Jalinoos said. "The barrage of commentary will likely force the market to scale back long dollar positions."

www.bloomberg.com/news/articles/2018-07-...-eu-for-manipulating

Please Log in or Create an account to join the conversation.

- alexgreat

-

- Offline

- Platinum Member

-

Less

More

- Posts: 638

- Thank you received: 18

5 years 8 months ago #120854

by alexgreat

alexgreat replied the topic: Market Sentiment shifting

Russia has left the top-30 list of top lenders to the United States by radically slashing US Treasury bills ownership. RT-polled analysts have shared their opinion on the move.

“Both political and economic reasons could be found here. The Central Bank may have thought that Russia-owned Treasuries could be frozen because of geopolitical tensions. The regulator announced in spring that it plans to diversify its reserves,” said Zhanna Kulakova, financial consultant at TeleTrade.

The analyst thinks the Russian central bank could re-invest the money from the sale into Chinese bonds and gold. “Gold is a tangible asset that can not be completely depreciated under any circumstances. In periods of global financial or political crises, gold will be much more useful than securities or cash,” Kulakova said noting that gold is also prone to price fluctuations from time to time.

www.rt.com/business/433950-russia-us-treasury-dumping/

“Both political and economic reasons could be found here. The Central Bank may have thought that Russia-owned Treasuries could be frozen because of geopolitical tensions. The regulator announced in spring that it plans to diversify its reserves,” said Zhanna Kulakova, financial consultant at TeleTrade.

The analyst thinks the Russian central bank could re-invest the money from the sale into Chinese bonds and gold. “Gold is a tangible asset that can not be completely depreciated under any circumstances. In periods of global financial or political crises, gold will be much more useful than securities or cash,” Kulakova said noting that gold is also prone to price fluctuations from time to time.

www.rt.com/business/433950-russia-us-treasury-dumping/

Please Log in or Create an account to join the conversation.

Moderators: RonS

Time to create page: 0.159 seconds